Cryptocurrency News

Crypto Markets and the US Election – Potential Implications

With 11 days left until the US Presidential election, global financial markets seem very complacent about the implications of the outcome of the major binary events of the year. The DeFi bubble had popped since August but other major tokens like Bitcoin and Ether had continued to perform well, above any upbeat expectations. But could that be the case during the next week, when the election will be even closer?

# Risk assets to stay downbeat

Based on past similar events, risk assets (stocks, crypto, currencies like Euro or Pound) are not performing well until the election uncertainty is elevated. Investors are shifting towards bonds, and safe haven currencies like the US dollar or the Yen, to protect themselves from wild market moves as well as an outcome that might not be favorable.

That had not been the case so far for cryptocurrencies, which had been boosted higher this week, following a major announcement from PayPal, a major fintech company that will support buying, selling, and storing several important tokens. However, we don’t expect to see valuations edge higher impulsively next week, given the high stakes involving the election.

# Stocks easing lower – a drag on crypto

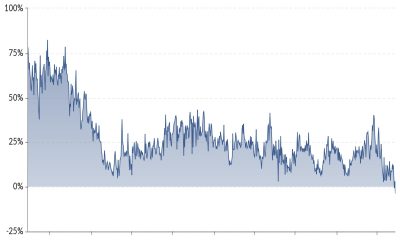

Another important factor to consider is that in 2020, stocks and cryptocurrencies had been positively correlated. Aside from the connection between volatility and price, Bitcoin and its peers benefited from a good mood on the global stock markets, erasing the losses from the March selloff.

In case stocks will be under pressure as the Presidential election gets closer, that would shift to a headwind for cryptocurrencies and at least a corrective move could start to form. That is a scenario in which taking long-term positions is not suited.

# The positive scenario

However, correlations are not fixed and can change quickly. We should also not exclude a scenario in which cryptocurrencies manage to hold their ground while other asset classes stay under pressure. Although we believe this is a low-probability scenario (because investors that have allocations in stock also have in Bitcoin and other cryptos), it should be taken into account because the election outcome might not have a massive influence on the cryptocurrency market.

Of course, the development of government-backed digital money will be a major risk for the global adoption of traditional cryptocurrencies, but that seems to be something years away into the future. Our final say is that people should remain cautious in the days ahead because that would be the market mood near the US Presidential election.