Altcoin News

Price Insolvency Risk Boosts as Bitcoin Tries to Achieve $18K

United States – Bitcoin struggles in reaching $18,000 and the price liquidation risk boosts as this crypto struggle. Experts think it might get burned soon.

Bitcoin had a mixed reaction on December 9 as prices displayed a 7.4% boost compared to 2021, which was after the November report. The information indicated that wholesale expenses will increase, and inflation might last more retentive than the belief of investors. Oil prices are still under the radar of investors, wherein the crude WTI hits a new yearly low, which is $71.10 on December 8.

DXY or the United States Dollar Index is a measure of the strength of the dollar over a bask of top international currencies, where it sustained the 104.50 level. However, the index exchanged at 104.10, which is a 5-month low on December 4. The movement signals low belief in the ability of the US Federal Reserve to reduce inflation without starting an important recession.

Trader gutsareon stated that the rough activity caused influence shorts and longs to be liquidated. However, a failed temporary dump under $17,050 followed it. As per the analysis, the open interest inertia on futures contracts suggested low certainty from bears.

Regulatory ambiguity might have portrayed a significant role in limiting the upside of Bitcoin. On December 8, the US SEC or Securities and Exchange Commission (SEC) announced new guidance that might see publicly exchanged companies reveal their exposure to digital assets.

The Division of Corporation Finance of the SEC stated that the previous crisis in the digital asset industry triggered widespread disturbance, and the US companies might have released obligations under federal securities laws to reveal whether the events might impact the business.

Margin markets give insight into how expert traders consider their positions since it lets financiers borrow digital asset to influence their positions.

One can boost exposure by borrowing stablecoins to purchase Bitcoin. On the other hand, Bitcoin borrowers can only short the digital asset as they bet on the price drop. The balance between margin shorts and longs is not matched all the time.

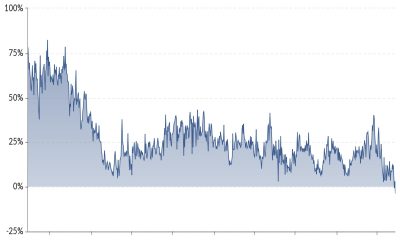

The OKX traders’ margin lending per OKX showed that it boosted from December 4 to December 9, suggesting that pro traders boosted their leverage longs despite failing multiple times in breaking the resistance level of $17,300. The metrics encourage stablecoin at 35, and it suggests that shorts are not confident about establishing bearish leveraged positions.

Traders should examine options markets to know whether Bitcoin will depart to the bearish newsflow. The delta sket of 25% is a speaking signal whenever market makers and arbitrage desks are swindling for downside or upside protection.

It becomes riskier for Bitcoin to leverage margin longs if it’s taking a while to recapture its price at $18,000. Traditional markets remain to play an important role in establishing the trend.