Cryptocurrency News

Why Crypto Market Prospects Are Uncertain During the Winter?

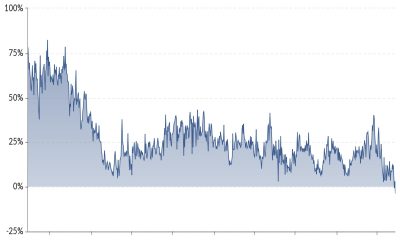

It had been quite a ride for cryptocurrencies thus far this year and even if the market will be in consolidation phase until the end of the year, the prospects for ending 2020 with gains are high enough. However, even though cryptocurrencies had been leading performers, several developments during the past few weeks are starting to cast a shadow over the winter and it would be important if you pay attention to them, as we start by highlighting three of the most important ones.

# The pandemic turns out to be a great challenge

Although a time of crisis, crypto appetite remained elevated and denominated in fiat, cryptocurrencies had been favored. For months, investors across all financial markets had ignored COVID-19, considering countries managed to cope with it well during the summer. Now that winter is coming in the Northern Emisphere, European countries and North America are witnessing a worrying increase in the number of new cases.

The second wave is far worse than the first one, which means countries need to put restrictions back in place. Germany, France, Belgium, and the UK already did it. That’s not the case for the US, even though cases are at record levels, but investors are cautious that the latest developments are not encouraging for high asset prices.

# High asset prices too decoupled from fundamentals

With aggressive interventions from central banks, asset prices had been propped up, leading to a K-shaped recovery. This decoupling from the broad economy is not occurring for the first time, but what we can learn from the past is that eventually, asset prices need to get back to normal levels, or the fundamentals will need to play catch up.

Faced with depressing prospects, the economic damage could be worse than anticipated, so that should be in our mind in case cryptocurrencies start to weaken impulsively.

# Disputed US election?

In our past article, we’ve talked about the US election and some potential implications on the financial markets. There are just a few days until the event and the most negative development that could occur is a disputed election. If either of the candidates won’t accept the result, the country could be up for up to a few months of legal battles.

Risk sentiment could be damaged substantially if that would be the case, which is why it would be important to monitor not just how the results are shaping, but whether there will be any disputes after that happens.