Altcoin News

Tips for Dealing with Crypto Markets Dominated by Emotions

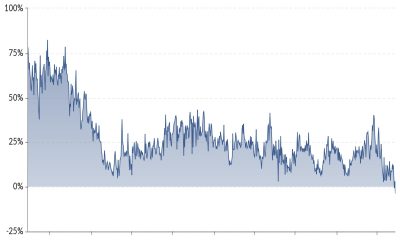

The past several months had thought us that the cryptocurrency market can behave irrationally for an extended period, regardless of the underlying fundamentals. Just recently we’ve seen Ether dropping by more than 30%, following a very impulsive run higher, suggesting something very interesting about the main drivers behind these price moves.

More specifically, it is obvious emotions are behind the decisions to buy or to sell, creating a difficult environment and raising challenges for traders/investors. Because of that, it is important to talk some of the best tips to engage in such conditions, helping you not fall into market traps.

Tip #1 Respect technical levels

When fundamentals are broken and the price does not perform based on underlying factors, the best way to deal with the market is by using technical analysis. Despite an irrational behavior, we will very often see the price respecting critical support/resistance area, or some price indicators working as a signal when overbought/oversold conditions occur. Breakout strategies are very efficient, especially if the price has a clear directional bias.

Tip #2 Don’t get caught into FOMO, FUD, or pump-and-dump schemes

Although we hear a lot talk in the media about FOMO, FUD, or pump-and-dump, there are still a lot of crypto/traders investors unable to resist the temptation of following the crowd. As human beings, we are social and we tend to gather into groups, developing similar behaviors. However, in this industry, we must get above our emotions and act independently, regardless of the euphoria/pessimism in the market.

Any trading/investing decision should be made based on your own set of rules and not because the market is hot. Emotional reactions lead to discretionary trading, and ultimately to losses that accumulate over time. The crypto appetite will fluctuate, but it will be your job to remain rational and take rules-based decisions each time you want to get involved in the market.

Tip #3 Keep risk under control

Excessive risk is always the main reason behind large losses. As the price moves further into a direction, market participants are increasingly confident it won’t reserve anytime soon, so they increase risk and market exposure. The damages are proportional to the risk taken and there is no surprise that most of the retail traders/investors end up losing money. To survive in the market for a long time, risk management should be part of the process. Discipline, diligence, and patience are skills that must be developed, or else, the consequences will be negative.