Bitcoin

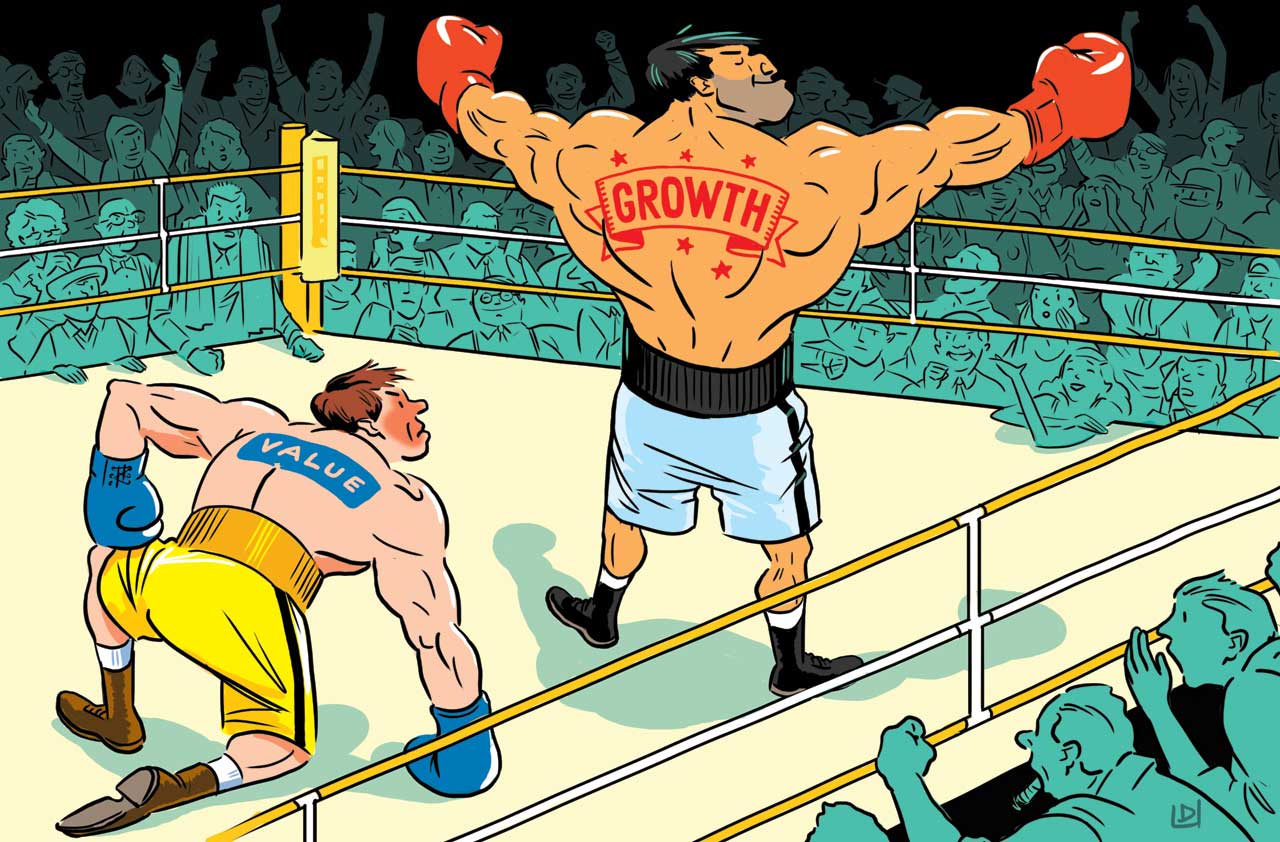

Growth vs. Value in the Cryptocurrency Industry

The cryptocurrency market is still in its infancy and because of that, there are plenty of critics and debates around the actual value of digital money. Unlike stocks, where investors not just buying a share of a company, but a share of the profit as well, we must acknowledge that there is no underlying valuable asset behind cryptocurrencies. Still, based on how things go, we are on our way towards a fully digitalized monetary system, a small talk on growth vs. value might be useful.

The speculative nature of cryptocurrencies

Cryptocurrencies don’t any physical form and represent just bits of information stored on a digital network called the blockchain. Tokens are actually private keys store inside virtual blocks that can’t be modified once created and confirmed by the network. Without any asset backing traditional cryptocurrencies, investors like Warren Buffett or Ray Dalio had not been too optimistic about Bitcoin and its peers.

Stablecoins and security tokens seem to be enjoying greater popularity among traditional investors, but there is still a reticence when it comes to embracing a new type of money. Without nothing valuable as an underlying asset, cryptocurrencies continue to have a speculative nature, the main reason why valuations had managed to rebound several times after bear markets happened. Because of that, long-term investments in cryptocurrencies don’t represent a viable solution at the present time and investors prefer to profit from short-term volatility.

Is value trade still possible?

Although critics continue to claim that cryptocurrencies are worth nothing, in reality, some tokens are able to disrupt major sectors of the economy and their ability to do that is inherently valuable. Technology is a tool and if it can improve productivity in any way, then it could be implemented in the future.

This means that value trade in the cryptocurrency space is not actually inexistent. The only major problem will be to find which tokens will be able to create disruptions in the long run. Considering that the probability of nailing the right token is reduced, a cryptocurrency investor must know how to manage risk and build a portfolio.

In reality, although there is a physical form of cryptocurrencies, the underlying technologies and the potential to generate improvements in certain economic sectors make them valuable in some form. The issue is that value is a very subjective aspect and people will give their own impressions, without acknowledging their limitations to a set of beliefs.