Blockchain Technology

Decentralized Finance and Its Potential in 2020

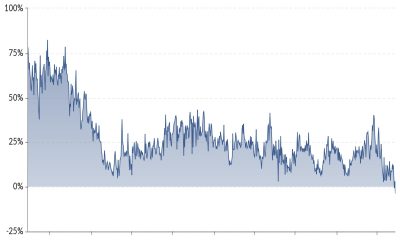

Since Ethereum had been developed, decentralized applications entered the world stage, and thus a new trend for digitalization begun. Cryptocurrencies and blockchain enabled a new realm of possibilities, with one of them represented by decentralized finance (DeFi). This trend had started recently, but over the past year saw exponential growth. If in 2019, the total monetary value locked in DeFi apps was approximately $276 million, it is now over $2 billion. Due to this rapid rise, we should take a look at the industry.

dApps to replace traditional apps?

With dApps continuing to grow in dominance, cryptocurrency investors could continue to change how they allocate capital. That happens because dApps and traditional apps are far apart in terms of how they function. With protocols like HTTP, companies are able to built data directly on the application layer, thus reducing the focus on the underlying protocols.

In the blockchain-based applications, the situation is completely different. That happens because most of the value is concentrated at the protocol layer and the app layer provides only a limited interface service. With a shared protocol layer, dApps stand out hugely, given the blockchain networks can’t own a certain interface (they are each built independently). This opens up a new road for how companies will be building their software.

Do dApps have many functionalities?

The most favored blockchain in terms of DeFi is Ethereum because most of the dApps are built on this platform. Smart contracts had enabled lenders and borrowers to interact, leading to the creation of a lending and credit system denominated in crypto. There are many ways to integrated dApps, but when it comes strictly to DeFi, this technology had enabled broader cryptocurrency liquidity flowing into the market.

Although the main focus is on the implications of the positive correlation between crypto and stocks, it is also important to take into account that the markets had recovered from the 2018 lows largely because there was additional cryptocurrency liquidity floating around. The growing DeFi sector will continue to create more lending via smart contracts and in return, the market could continue to grow.

There are many applications for dApps, but from our point of view, this year the focus will be on the DeFi sector and how it can supply the market with the needed liquidity. At the same time, this could be the start of a new financial industry based on the blockchain, and maybe traditional banks will start to use it in the not-too-distant future.