Altcoin News

GBTC Bitcoin Rebate Comes Near 50% After FTX Crisis

United States – GBTC or Grayscale Bitcoin Trust shares become cheaper than Bitcoin, allowing crypto users to purchase for Lawrence Lepard and ARK Invest.

The biggest Bitcoin-established investment vehicle is becoming more suspicious as it exchanges at a discounted rate. GBTC is the biggest Bitcoin industry individual to feel the tension from the fiasco against FTX, the outdated exchange.

Misgivings impact the trusted and best-known cryptocurrency industry names, which comes with contagion. These misgivings provide fear of a deeper crypto market defeat in all places in Bitcoin and crypto altcoins.

In the past days, it was the start of GBTC, the long-beleaguered BTC or Bitcoin financing fund, despite having problems with Genesis Trading, a related digital asset firm.

Cointelegraph reported that DGC or Digital Currency Group, the parent company of GBTC, and GBTC wanted to reassure shareholders and the crypto market that the flagship product is economically impermeable. However, it didn’t appear to fulfill users, leading to further public statements on faith in GBTC and DCG. Coinbase institutional was among these investors, the arm of big crypto exchange Coinbase.

A tweet gathered the attention of some users, stating that nothing is more crucial than ensuring the clients’ assets are safe.

Coinbase Institutional is pleased to give isolated cold space custody services to their qualified custodian, who has ten years of expertise in establishing a secure custody solution.

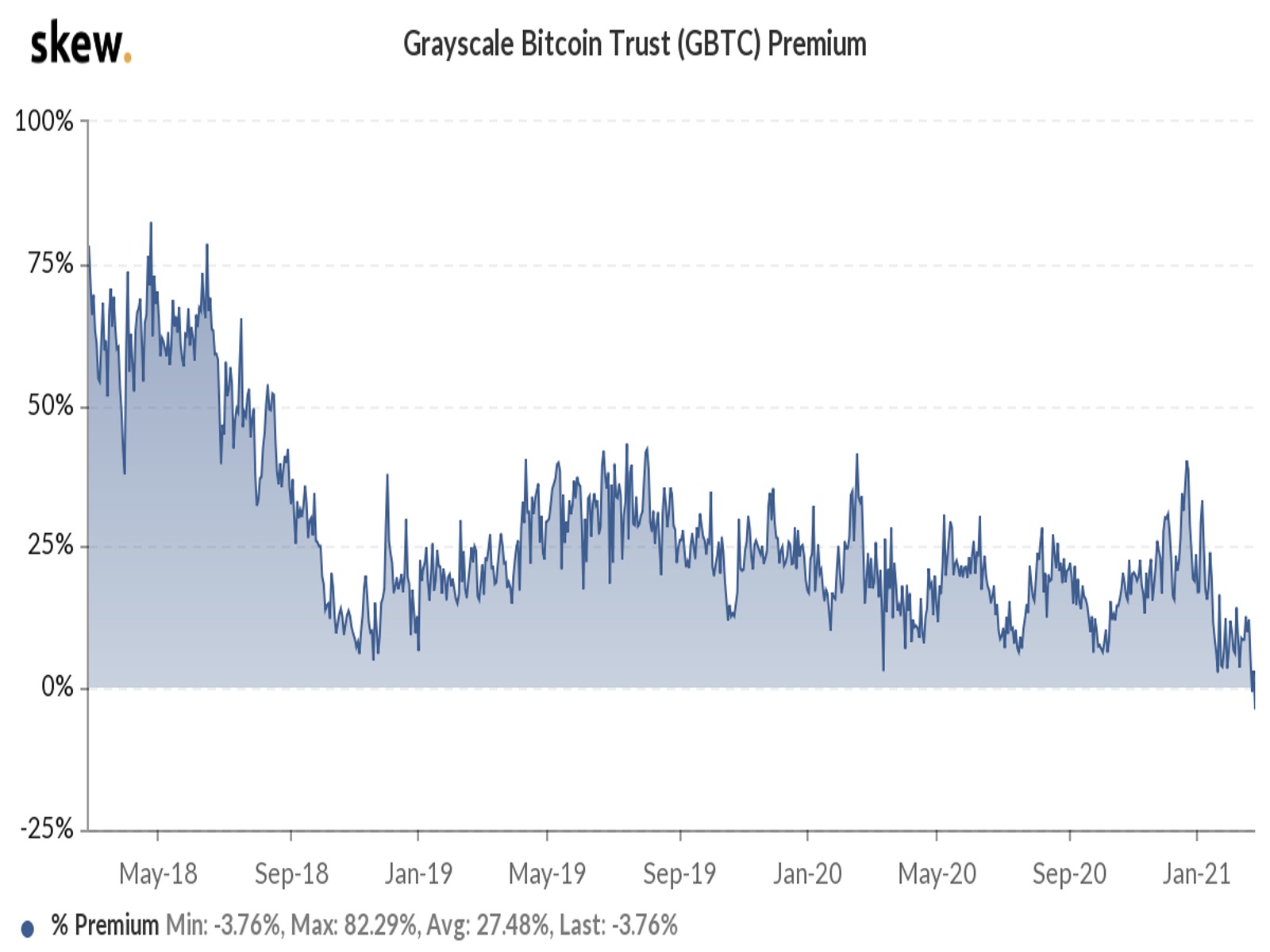

The image of GBTC was under stress for some time. Since 2021, it has been exchanged at a discount to the spot price of Bitcoin, which is far from 50%. Speculation is boosted despite the lack of pressure, thanks to allegations about the acquisition of GBTC if Genesis Trading fails. The shift of tack might have consequences for GBTC as the company speculatively stays focused on changing it to ETF or Exchange-traded Fund.

The CEO of GBTC, Michael Sonnenshein, tweeted that he’s optimistic about the crypto industry’s future even though it’s a tricky moment for some users.

Lyle Pratt, Vida Global’s creator, stated that Genesis might go under, yet the liquidated GBTC trust is odd. The movement is as if someone, such as Fidelity, acquires and continuously operates it.

The steepening reduction following the FTX saga has made GBTC popular, like Lawrence Lepard, Equity Management Asscoaites’ investment manager, and ARK Invest. The view of Lepard on GBTC and Grayscale gathered many questions. According to a tweet, he’s been purchasing more, yet it’s still below 5% of the BTC holdings.

Lepard acknowledged that it’s improbable to know the distress they are in. He resumed analyzing the fallout in case the worst scenario occurred: bankruptcy.