Altcoin News

Anticipating a Cryptocurrency Market Top: 4 Key Indicators to Watch

1. Exhausted Buying: Learning from the Past

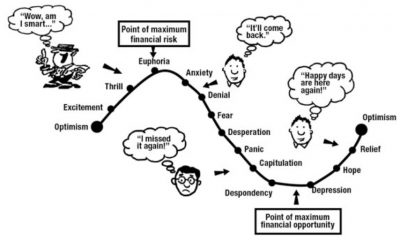

The 2017 crypto market offers insights into exhausted buying as a signal of a topping formation. Bitcoin, along with numerous altcoins, broke new all-time highs consistently, with their valuations climbing almost vertically. Although unsustainable in the long run, it’s crucial to time these trends correctly as the upswing can often overextend.

2. Engulfing Reversal Signal: A Bear Market Indicator

Cryptocurrency’s worth as a value hold notwithstanding, bear markets are inevitable, often indicated by engulfing reversal signals. Those using candlestick charts should note when a candle engulfs the preceding one, especially at the end of a bullish upturn. It’s particularly beneficial if this occurs near a key resistance area, indicating potential order flow to support a downside shift.

3. Pinbar or Fakeout Signal: A Painful Hint of Market Top

Pinbars and fakeout candles can wreak havoc on buyers, but for sellers who correctly anticipate a top, these offer high-potential reversal signals. Sellers can benefit from optimal pricing and mitigate the need to manage a negative position over a prolonged period. Like the engulfing reversal signal, it’s critical to assess whether this happens around the resistance zone to reduce the likelihood of a false reversal.

4. Extremely Overbought Conditions: Using Oscillators as Warnings

Retail traders often utilize oscillators to identify extreme overbought conditions. Higher timeframe indicators such as RSI or Stochastic may act as precursors to a market downturn. Look out for extreme readings and couple this method with at least one of the above-mentioned signals. Remember, an asset can remain in the overbought zone for an extended period, adding to the challenge of anticipating a topping formation.