Cryptocurrency News

XRP ETFs Show Strength Amid Broader Crypto ETF Weakness

Introduction

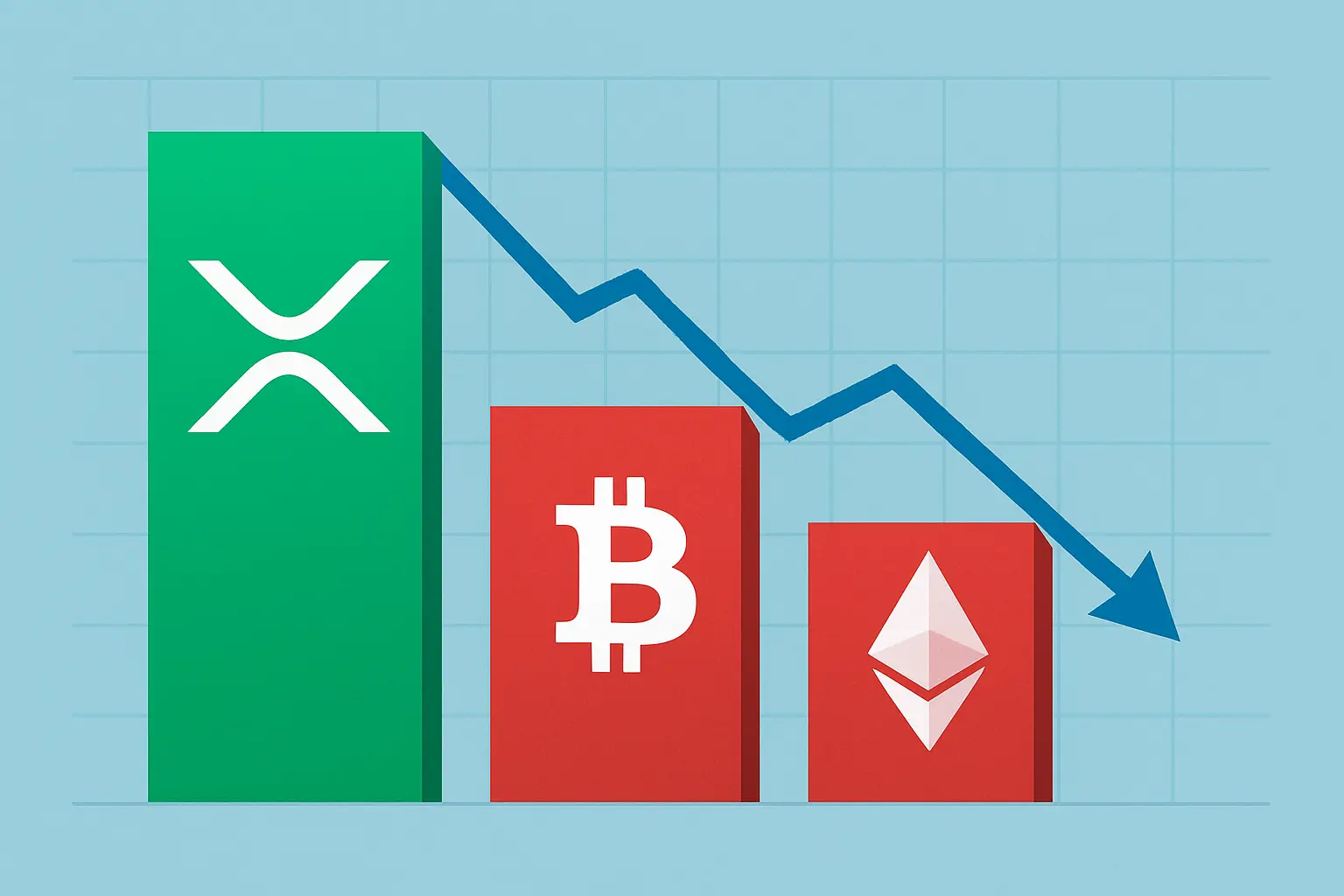

The global cryptocurrency market has entered a complex and revealing phase as exchange traded funds tied to digital assets reflect diverging investor behavior. While Bitcoin and Ethereum exchange traded funds have seen billions of dollars in outflows over recent weeks XRP based ETFs have quietly recorded a full month of consistent inflows. This contrast is reshaping conversations around institutional confidence, regulatory clarity and the long term positioning of major crypto assets. The steady inflow into XRP related investment products suggests a meaningful shift in sentiment at a time when the broader crypto market is under pressure from macroeconomic uncertainty tightening liquidity conditions and regulatory developments.

Understanding The Divergence In ETF Flows

The contrasting ETF flow data reflects deeper structural forces shaping the crypto market. Bitcoin and Ethereum ETFs have experienced net outflows estimated in the billions over the past month as investors reassess risk exposure amid volatile price action and global monetary tightening. Rising interest rates reduced liquidity and cautious equity markets have all contributed to a more defensive posture among institutional investors.

XRP ETFs however appear to be benefiting from a different set of dynamics. Rather than being viewed purely as speculative assets XRP is increasingly framed as a payments focused digital asset with real world use cases in cross border settlements and financial infrastructure. This functional positioning may be insulating it from the broader risk off sentiment affecting other cryptocurrencies. As traditional investors become more selective XRP ETFs are emerging as an alternative exposure within the digital asset space.

The Role Of Regulatory Clarity In XRP’s Momentum

One of the most significant drivers behind the sustained inflows into XRP ETFs is regulatory clarity. Unlike Bitcoin and Ethereum which still face evolving scrutiny across multiple jurisdictions XRP has benefited from clearer legal interpretations in key markets. The long running legal dispute involving Ripple and US regulators created uncertainty for years but recent developments have reduced existential risks around XRP’s classification.

For institutional investors regulatory clarity is not optional it is foundational. ETFs operate within strict compliance frameworks and fund managers prioritize assets with lower legal ambiguity. XRP’s improving regulatory outlook has made it more attractive for structured investment products particularly in regions where crypto regulations are tightening. This clarity has translated into increased confidence among asset managers and long term investors seeking exposure without outsized compliance risks.

Institutional Strategy Shifts And Portfolio Rebalancing

The inflows into XRP ETFs also reflect broader changes in institutional portfolio strategy. As crypto matures investors are no longer allocating capital based solely on market dominance or brand recognition. Instead they are evaluating assets through the lens of utility network adoption and alignment with traditional financial systems.

Bitcoin is increasingly viewed as digital gold and Ethereum as a decentralized computing platform. While these narratives remain powerful they are also well understood and heavily priced into existing products. XRP by contrast occupies a niche focused on enterprise payments liquidity solutions and financial intermediaries. This differentiation allows it to serve as a complementary holding rather than a competing one.

Market Performance And Investor Psychology

Market psychology plays a crucial role in shaping ETF flows. Bitcoin and Ethereum have experienced sharp price swings over recent months triggering profit taking and defensive exits from ETF products. Large outflows often create feedback loops where falling prices reinforce negative sentiment leading to further redemptions.

XRP’s relatively stable performance during the same period has helped support investor confidence. Stability does not necessarily mean price appreciation but it does reduce volatility related anxiety. For conservative institutional investors ETFs that avoid extreme drawdowns are more attractive especially during uncertain macroeconomic cycles.

This psychological aspect should not be underestimated. ETF investors often prioritize capital preservation alongside growth. XRP ETFs appearing more resilient in turbulent conditions enhances their appeal and supports continued inflows even when broader crypto sentiment is subdued.

Global Adoption And Payments Infrastructure

Another factor supporting XRP ETF inflows is the growing narrative around global payments infrastructure. Financial institutions and payment providers continue to explore blockchain based settlement systems to improve efficiency and reduce costs. XRP’s design and long standing focus on cross border payments position it as a candidate for such use cases.

While adoption has been gradual the perception that XRP is aligned with real world financial processes strengthens its investment case. ETFs offer institutional investors exposure to this narrative without direct operational involvement. As discussions around tokenized assets, digital currencies and blockchain settlements gain momentum XRP stands to benefit from its established role in these conversations.

Comparison With Bitcoin And Ethereum ETF Outflows

The scale of outflows from Bitcoin and Ethereum ETFs underscores the significance of XRP’s inflows. Billions of dollars exiting BTC and ETH funds reflect a reassessment of risk rather than a rejection of these assets altogether. Many investors are rotating capital rather than leaving the crypto market entirely.

Some of this capital appears to be flowing into alternative assets like XRP ETFs which offer differentiated exposure. This rotation highlights a maturing market where capital allocation is increasingly nuanced. Instead of blanket bullish or bearish positions investors are making selective choices based on regulatory comfort market positioning and perceived upside.

Bitcoin and Ethereum remain foundational assets within the crypto ecosystem but their dominance in ETF flows is no longer absolute. XRP’s ability to attract sustained inflows during this period signals a meaningful evolution in institutional behavior.

Long Term Implications For The Crypto ETF Market

The success of XRP ETFs over the past month may influence future product development and regulatory approvals. Asset managers closely monitor flow data to identify demand trends. Consistent inflows demonstrate investor appetite and can encourage the launch of additional XRP related products across different jurisdictions.

Moreover this trend could prompt regulators to take a more nuanced view of crypto assets. Seeing structured compliant products attract stable investment may reinforce the case for clearer regulatory frameworks. Over time this could benefit the entire crypto ETF market by reducing uncertainty and fostering broader participation.

The divergence in ETF flows also highlights the importance of narrative and positioning. Assets that align with institutional priorities such as compliance utility and stability are likely to outperform in ETF markets even during periods of broader volatility.

Risks And Considerations For Investors

Despite the positive inflow data XRP ETFs are not without risk. The crypto market remains inherently volatile and regulatory landscapes can change. While XRP has gained clarity in certain regions it still operates within a global system where rules differ significantly by jurisdiction.

Additionally ETF inflows do not guarantee long term price appreciation. They reflect demand for exposure rather than underlying adoption metrics. Investors should consider macroeconomic factors, technological developments and broader market sentiment when evaluating XRP ETFs.

However the ability of these products to attract capital during a challenging period for crypto markets suggests resilience. This resilience may not eliminate risk but it does indicate a degree of investor confidence that is notable given current conditions.

Conclusion

The one month streak of inflows into XRP exchange traded funds stands out against a backdrop of significant outflows from Bitcoin and Ethereum ETFs. This divergence reflects changing investor priorities, regulatory clarity and a growing appreciation for differentiated crypto use cases. XRP’s positioning within payments infrastructure and its improving legal outlook have made it an attractive option for institutions seeking selective exposure to digital assets.

As the crypto ETF market continues to evolve, flow data will remain a critical indicator of sentiment. The current trend suggests that investors are no longer treating crypto as a monolithic asset class.